Get IRS Tax Return Transcript

FAFSA is Available October 1st!

The Free Application for Federal Student Aid (FAFSA) is available October 1st and must be completed every year to receive financial aid.

Data Retrieval the Fast Easy Way

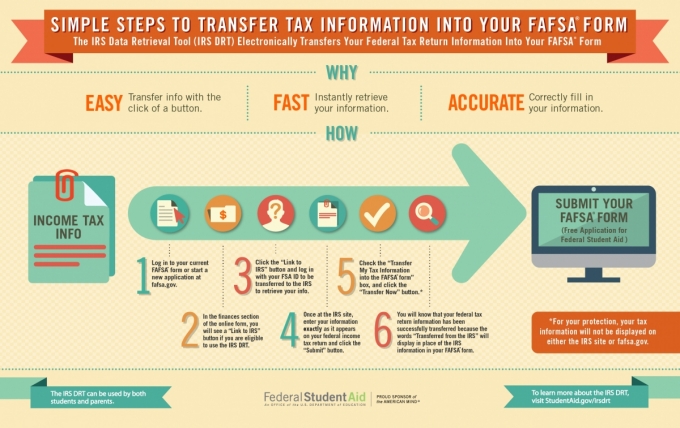

Students and parents are able to link to the IRS and transfer their Tax Return information to their FAFSA. This is a fast easy way to apply for financial aid and will satisfy most financial aid verification requirements. The Student Financial Aid Office highly recommends using the IRS Data Retrieval Tool during the initial filing or when subsequent corrections are made to your FAFSA.

Students and parents are required to report income and tax information from the prior tax year. Use the IRS Data Retrieval Tool to import your tax information. This will reduce the likelihood of conflicting information and simplify processing.

The Data Retrieval Process cannot be used in any of the following circumstances and FAFSA filers must submit Tax Return Transcripts and W2s:

- Parent provides invalid SSN

- Married and filed as head of household or married filing separately

- Filed amended return (please provide Record of Account which provides detailed information about changes)

- Filed tax return in Puerto Rico or foreign country

- Marital status changed after December 31

How to "Get Transcript Online"

FAFSA filers should use the IRS Data Retrieval tool when submitting FAFSA data.

FAFSA filers making changes to the IRS Data Retrieval information must also submit the following to the Financial Aid Office:

- Tax return transcript

- Copy of W2s

Steps to Import Tax Return Transcript Information

For assistance, contact your local IRS Taxpayer Assistance Center.