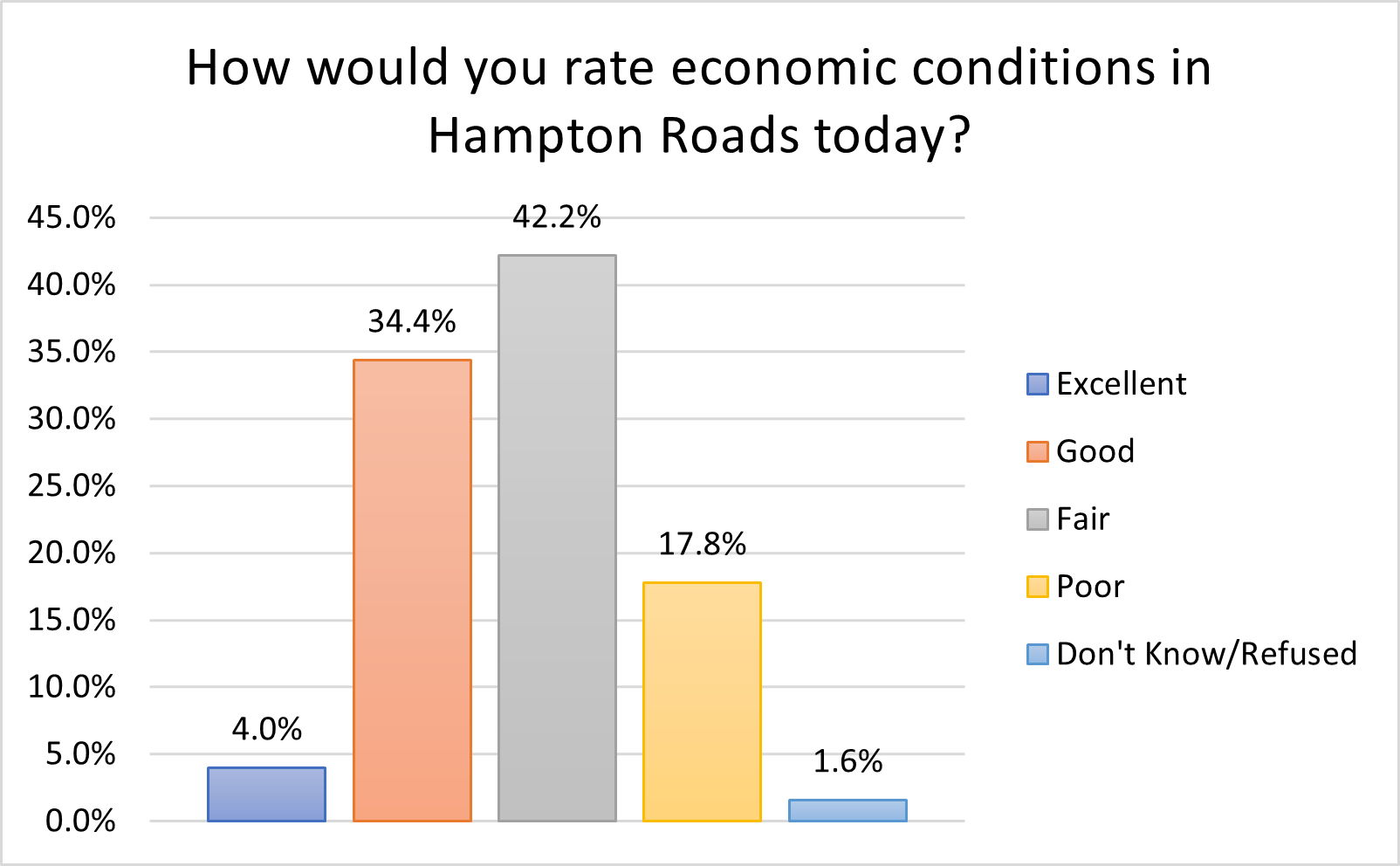

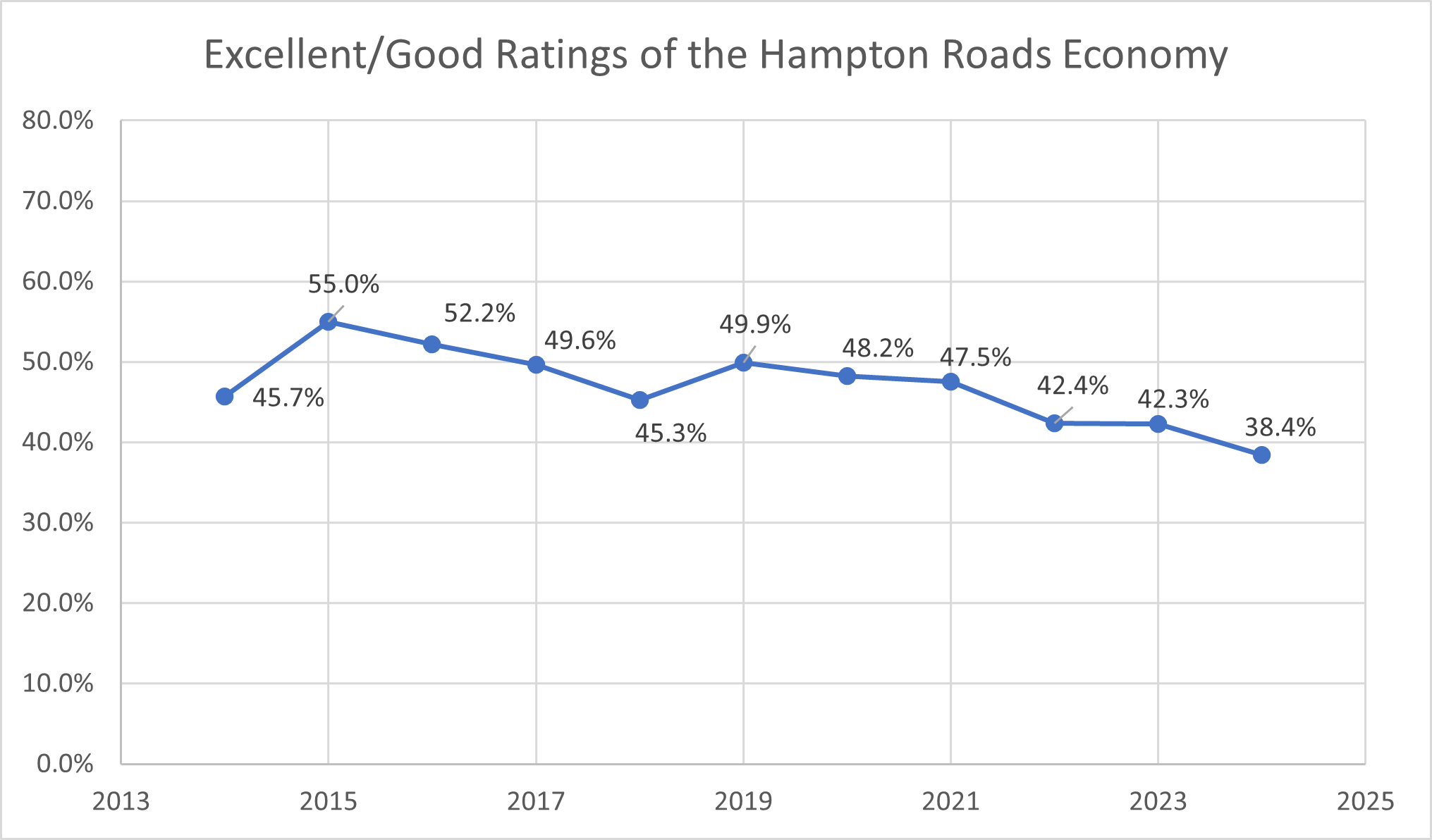

Hampton Roads’ residents continue to have a less than rosy outlook on the regional economy, with 60% of survey respondents rating economic conditions in the area as either fair (42.2%) or poor (17.8%), and only 38.4% of respondents indicating a rating of good (34.4%) or excellent (4%). Ratings of the economy have been on a downward trend since 2019.

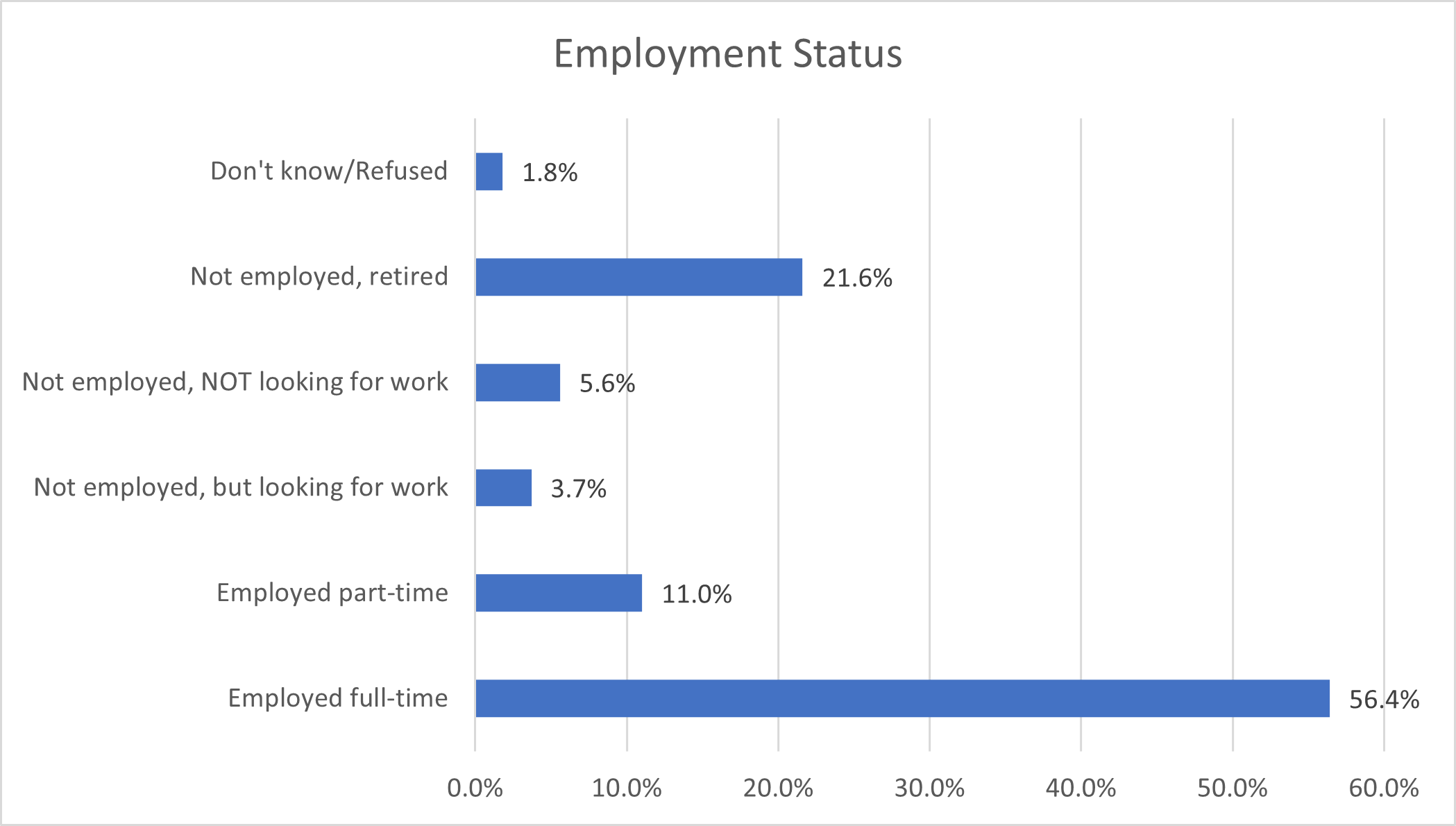

As can be seen from the graph below, more than half of those responding to this year’s survey were employed full-time (56.4%) while another 11% were employed part-time. Another 3.75% were not employed but looking for work (5.3%) while 5.6% were not employed and not looking for work. About one in five respondents (21.6%) were retired.

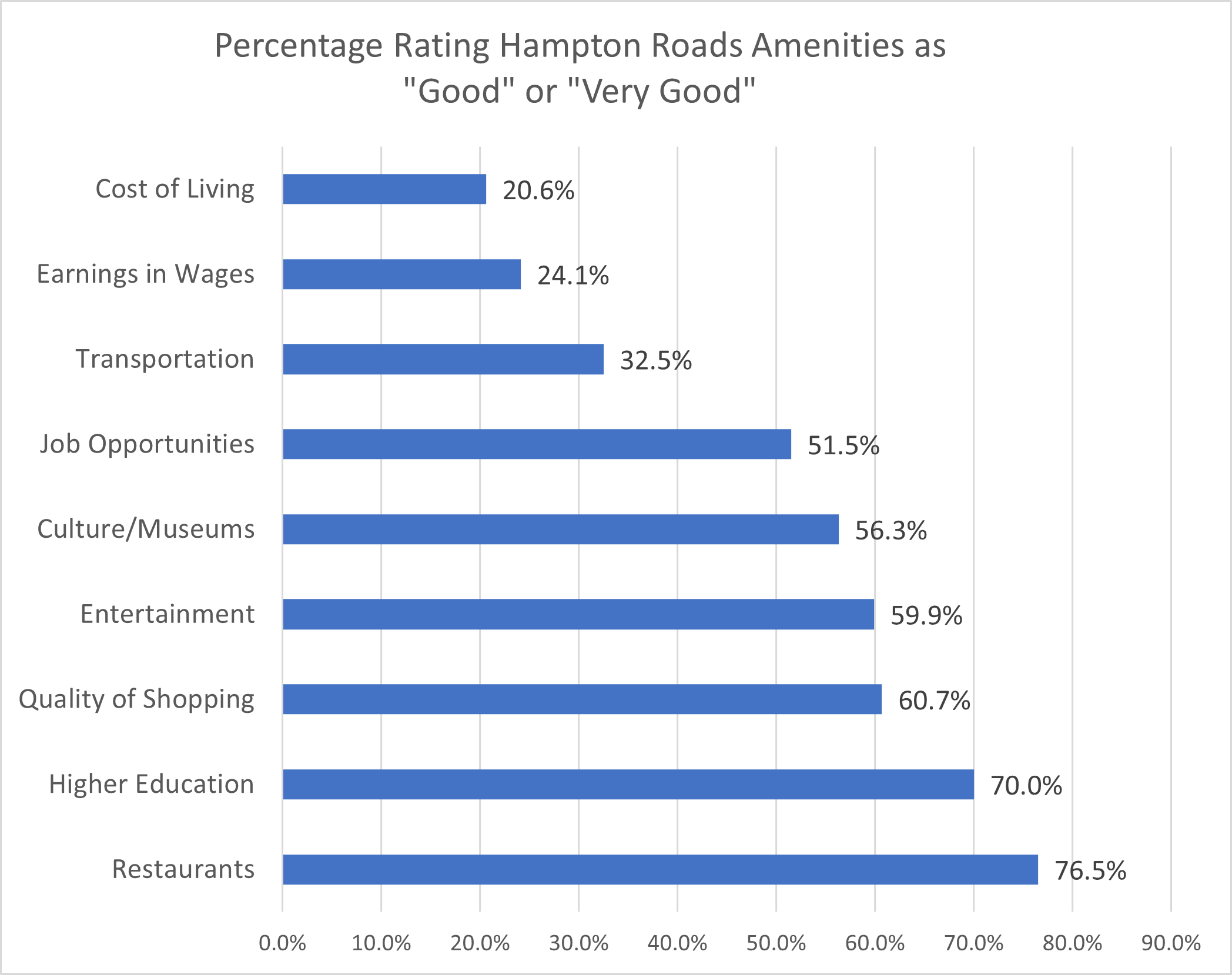

Part of what contributes (or detracts) from an area’s quality of life are the various amenities available to residents and visitors. Respondents were asked to rate a variety of amenities and other features in Hampton Roads on a scale of very poor to very good. Restaurants (76.5%), higher education (70%), and quality of shopping (60.7%) received the most “good” and “very good” ratings. Between 50-59% of respondents also rated entertainment (59.9%), culture/museums (56.3%), and job opportunities (51.5%) as good or very good. Transportation was rated as good/very good by only 32.5% of responding residents while earnings in wages (24.1%) and cost of living (20.6%) received the fewest good/very good ratings.